Calculating your Average Weekly Wage to Identify Your PPD Rate

This article will discuss how to calculate a PPD rate. I will also inform you how to know whether your PPD weekly rate will be capped by the Missouri Workers’ Compensation statute.

The PPD Rate is the second of three variables necessary to use / understand the Missouri Workers’ Compensation chart:

(i)The Starting Value [in Weeks] of the Body Part You Injured;

(ii) PPD Rate; and,

(iii) Percentage of Permanent Partial Disability.

Part One of this Understanding the Missouri Workers’ Compensation Chart blog series, discussed the first variable in great detail.

Part Two will help you determine what each of those weeks is worth. This is where Missouri Workers’ Compensation claims begin to translate into a discussion of money, by defining the dollars-and-cents value of a week (the “PPD Rate”). To know your PPD Rate, you must first calculate your Average Weekly Wage (“AWW”). Your PPD Rate is then 2/3 of that AWW.

For the reasons discussed herein, and more, this can become more complicated that it might seem.

CALCULATING THE AVERAGE WEEKLY WAGE (“AWW”):

For most of Missouri’s injured workers, you look at their pre-tax earnings within the 13 weeks prior to their injury. To be clear, the relevant amount of which I am speaking, is the amount of money you made within the 13 weeks prior to your date of injury BEFORE anything at all was taken, or otherwise deducted, form your pay. For reference, 13 weeks is usually pretty close to 90 days or 3 months.

When identifying the relevant period for each case, I find there are helpful tools online as opposed to hand-counting out the days on a calendar. Here’s the one I use.

Once you calculate your gross earnings within that relevant 13-week period, you divide it by 13, which reveals your Average Weekly Wage (“AWW”).

Wage Statement:

Since many of Missouri’s workers do not have a set salary that remains constant, you may be wondering how you know or verify what your gross earnings were during that 13-week period prior to your injury. Your Employer, and/or their Insurer, will have to provide what is usually called a “Wage Statement” upon request. This is a document where they have to swear to what your gross earnings were within the relevant period. If you have them, or can access them, you can also reference your pay stubs from that relevant 13-week period.

The Wage Statement is something we as attorneys will request immediately upon being retained by clients. It might be that your Employer, and/or their Insurer, has calculated your AWW in an agreeable way. If so, great. That said, often we find otherwise.

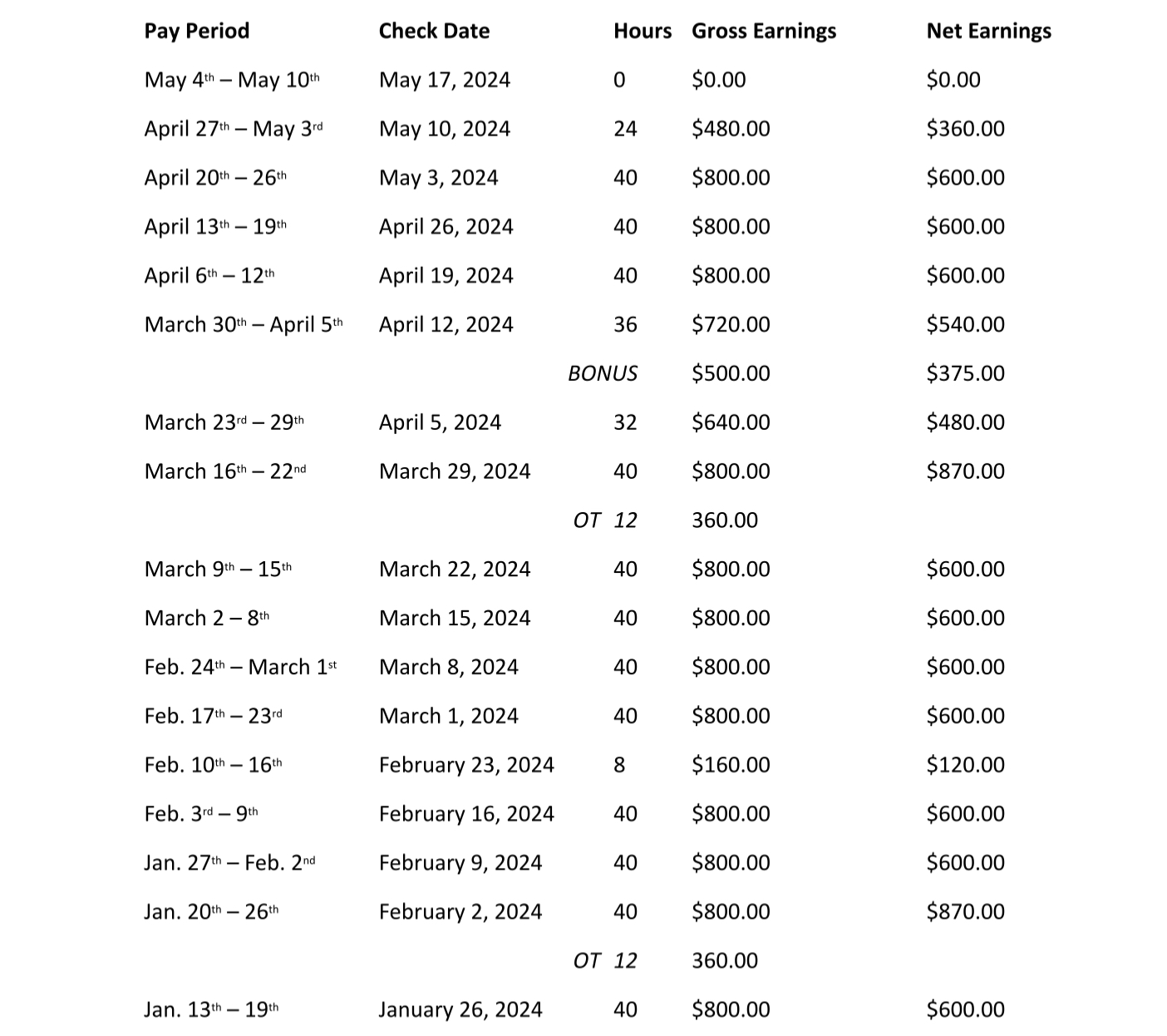

Here is a sample of what a wage statement might look like for someone injured at work on May 1, 2024 whose pay rate is $20.00 per hour for us to work with/from:

Sample/hypothetical Wage Statement

Since this hypothetical person was injured on May 1, 2024, we can identify their relevant 13-week period to be from February 1, 2024 to May 1, 2024.

Pay Date v. Pay Periods Within the Relevant 13-Weeks

If you use the ‘Check Date’ to identify gross pay within that period of time, that totals $10,740.00. If you divide that by 13, you get an AWW of $826.15.

If you use the ‘Pay Period’ within which the money was actually earned, the gross pay within the relevant period totals $10,060.00. If you divide that by 13, you get an AWW of $773.85.

Here, you can see that the difference between the two can be substantial / meaningful. At worst, it can give you something to talk about, or bargain with, as you would get to the negotiation stage of your claim.

Bonuses / Additional Forms of Pay

Whether you use ‘Check Date’ or ‘Pay Period’, if you do the math, you will notice it includes the bonus within the relevant period. ALL gross pay should be considered if it was earned/paid within the relevant period. Always make sure the wage statement you are provided shows any and all forms of pay, not just gross compensation for hours worked. This can make a big difference.

Your Pay Was Less the Week of the Injury

In the example using ‘Pay Period’ to compute the AWW, you will notice it considers the week within which this hypothetical person was injured (April 27th to May 3rd). The law allows the week of the injury to be removed from the calculation. In many cases, this can be something you will want to do if/when possible. If you earned less money the week you were injured due to your injury keeping you from working, it would not be fair for that to have a negative impact on what your AWW might otherwise be.

So, for the hypothetical worker example here, you would remove the week of the injury ($480 gross pay), which leaves $9,580.00 in total gross pay over 12 weeks. That, divided by the now relevant 12 weeks, results in an AWW of $798.33. That is a substantial improvement from what was $773.85 above.

Overtime Pay

Additionally, with either the ‘Check Date’ or ‘Pay Period’ approach, you will notice this hypothetical employee worked some overtime. That should be accounted for in your gross total calculation as well. Make sure that the wage statement you are provided reflects any and all overtime pay as well. This too can make a substantive difference in maximizing the value of your workers’ compensation case.

Missed Time During the Relevant Period

If you happened to miss significant time during the relevant period, that can make the math extremely disappointing or unfair. In most cases, you can rectify this. Typically, it would be that for every five days of time missed, you can remove a week from the AWW calculation.

In the example above, you can see the hypothetical worker happened to have missed 44 hours in the relevant period leading up to the date of injury. Since a typical week for that hypothetical worker was 40 hours, we would argue a week should be removed from the math in that hypothetical. So, if there were otherwise 13 weeks, you would instead divide the same gross total by 12; and, if there were otherwise 12 weeks, you would divide the same gross total by 11. In order to reduce the week total in this instance, you do not need to deduct any money from the gross total.

Since in this hypothetical the ‘Check Date’ approach to computing total gross pay during the relevant period resulted in a larger figure, we will use that to demonstrate how missed pay during the relevant period can be applied. As you saw above, that approach resulted in an AWW of $826.15 when the $10,740.00 gross total was divided by 13. Since the hypothetical person missed 44 hours within that period, you can argue that same figure should instead be divided by 12 weeks. That makes the AWW $895.00.

If you use the ‘Pay Period’ approach within which the money was actually earned, the gross pay within the relevant period totals $10,060.00. If you divide that by 13, you get an AWW of $773.85.

How Different the Same Numbers Can Be

The Employer, and/or their Workers Compensation Insurance Company, is likely to do the math in a way that is most favorable to them. As you have seen, even where everyone is working from the same numbers, the math can be very different.

In the hypothetical, using the same wage statement, the Employer/Insurer could use the ‘Pay Periods’ within the relevant 13-weeks, leave in the week of the injury, not account for bonuses or overtime, and fail to account for the missed week of time within the relevant period. With that approach, the AWW would total $707.69.

Using the same hypothetical wage statement, you could use the ‘Check Date’ to total your gross pay within the relevant period, throw-out the week of the injury, account for bonuses and overtime, and reduce the number of weeks by which you divide due to missing greater than one week of time in the relevant period prior to the date of injury. If you did, the AWW would total $895.00.

That is a $187.31 difference in AWW depending on who analyzed the exact same numbers! That may not seem like much on its own, but since your case value is measured in weeks of wages, even much smaller differences can mean thousands of dollars to you.

CALCULATING THE PERMANENT PARTIAL DISABILITY (“PPD”) RATE:

Once you have taken the time to identify your AWW, calculating your PPD Rate is relatively easy. Your PPD rate is 2/3 of your AWW. If you have a calculator, or one on your phone, simply multiply your AWW by 0.6666666.

So, if the hypothetical person’s AWW is $895.00, their PPD Rate would be $596.67.

This figure, NOT the AWW, is the monetary value of each week (the ‘little numbers’) on the workers’ compensation body diagram. The PPD Rate is the second variable you need in order to be able to complete the math considered by the Missouri Workers Compensation Settlement Chart.

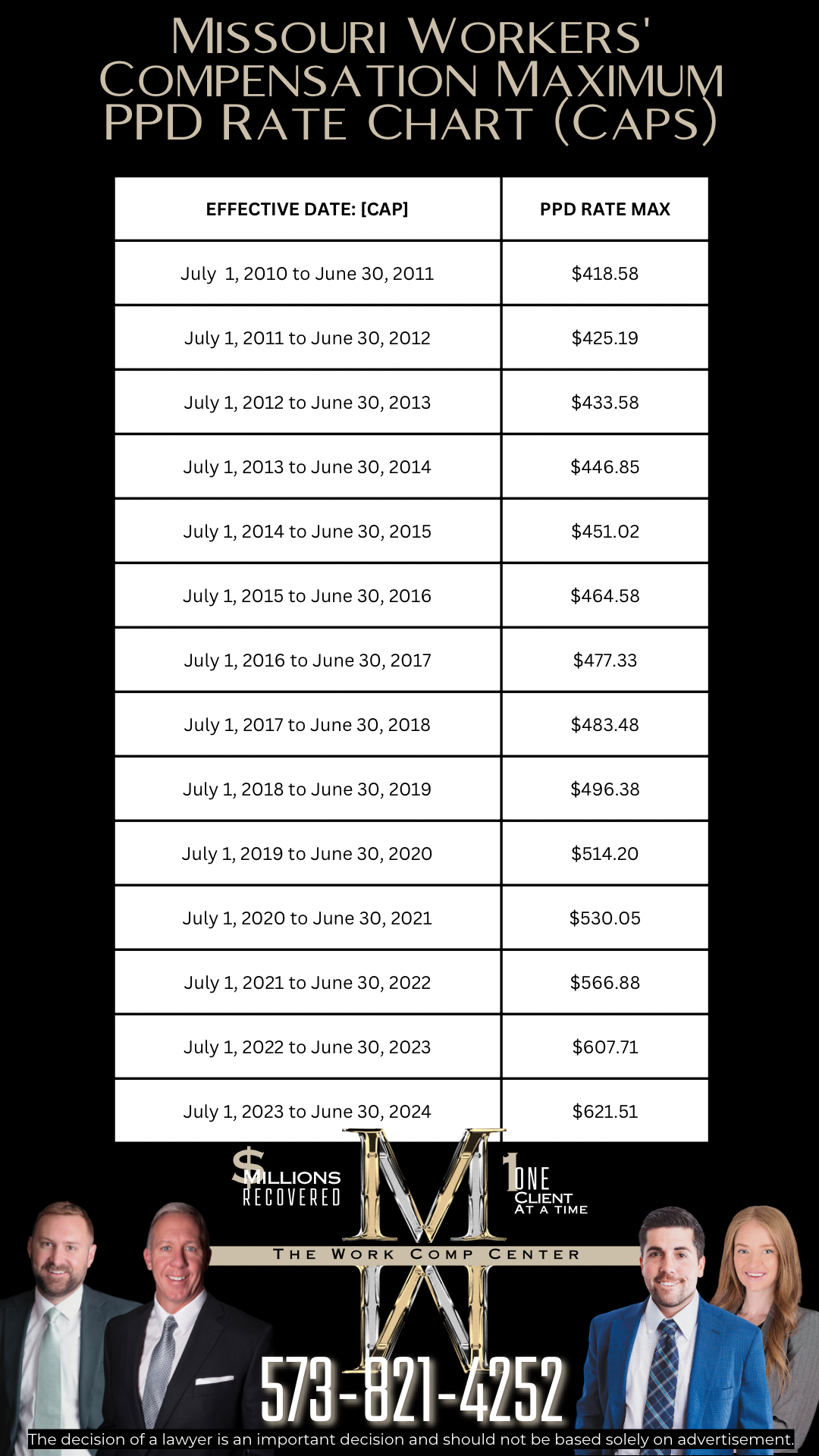

Maximum PPD Rate Caps:

Once you have the AWW, the PPD Rate determination is as simple as it seems. That said, there is one qualifier to be aware of: Max PPD Rates. Depending on the date of your injury, your PPD rate might be capped. In other words, if your PPD Rate is beyond a certain amount, your PPD Rate and the PPD Rate of the world’s richest person would be the same.

To use the same hypothetical example that we have been, the statutory maximum PPD Rate for the May 1, 2024 date of injury is $621.51. Since we would be arguing a PPD Rate of $596.67, that hypothetical person’s PPD Rate would not be affected by the statutory cap. It would simply be two-thirds of the AWW.

If the same person, with the same pay, suffered the same work-related injury on May 1, 2021; their PPD Rate would be reduced to the statutory PPD Rate maximum of $566.88 for that date of injury.

For reference, the statutory maximum PPD Rates, and their associated effective dates, are provided below. If you know the date of your work injury, locate which date range it falls within to learn the PPD Rate cap relevant to your case:

Missouri Workers’ Compensation Maximum PPD Rate Chart (Caps)

Note: These are the statutory caps for PPD Rate only. The caps for the same date ranges are different for things like TTD and PTD. For the other caps, or if you do not see the date range associated with your date of injury, locate a MO WC-110-2 Form or call us now at 573-302-7211.

The next blog article will discuss the percentage of permanent partial disability. That will be the last variable needed to complete the math considered by the Missouri Workers’ Compensation Chart.

FOR MORE INFORMATION OR CLARIFICATION:

CLICK HERE AND SUBMIT A FORM FOR A FREE CONSULT

CALL 573-821-4252 TO SCHEDULE A FREE CONSULT

EMAIL: br**@*********aw.com